The 4 Phases Of COVID-19’s Business Impact on FMCGs

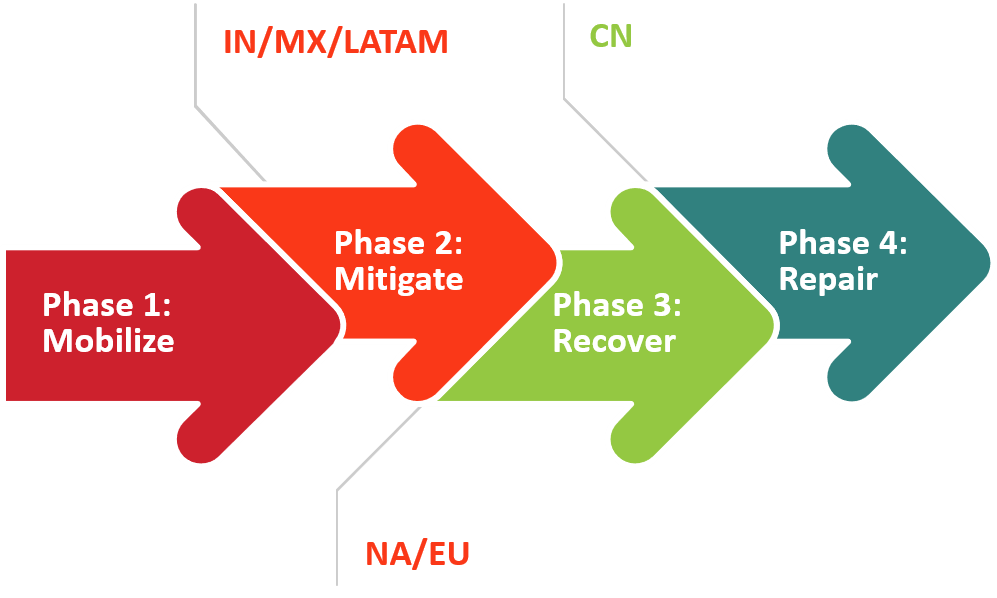

When the COVID-19 crisis first hit the US around the first week of March, RSi’s SVP of Customer Acceleration, Mike Quinn, started to look for a general model to explain the roller coaster that CPGs would be going through. He adopted the Four Phases of Crisis Management, a setup that has been used to assess natural disasters, and home in on what’s most important as you move through the crisis.

In a recent webinar, he walked attendees through how these phases apply to the CPG business and what they should be expecting in the coming months.

The 4 Phases of COVID-19’s Impact on CPGs

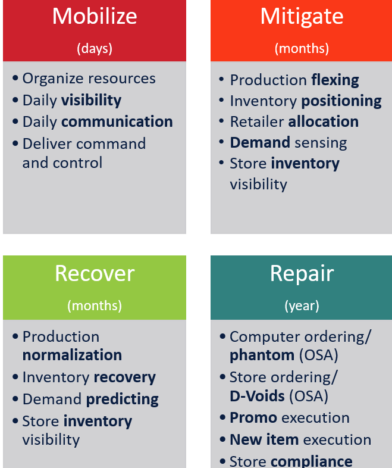

Mobilize (measured in days)

Applied to the CPG industry, the “Mobilize” phase is most associated with the time when many suppliers saw sales skyrocket by 100-200%+. They established a variety of measures – daily visibility from upstream supply chain down to store-level sales; extensive communication across their business, with their retailer partners and their vendors; and more importantly, workplace safety. A majority of countries have already exited this phase and are progressing through the next stage.

Mitigate (measured in weeks)

The “Mitigate” phase is characterized by the time period that while total sales are still up, volatility isn’t as rampant, and most categories have begun to see sales stabilize – in this instance, for many goods readily consumed at home it’s around +50%. These CPGs are beginning to flex production up, position their limited on-hand inventory, and work through appropriate allocation with retailer partners. Their main focus should be on fully understanding what inventory their retailers have and deciphering what the true demand is, as it’s still changing.

Recover (measured in months)

Entering the “Recover” phase, CPGs will be normalizing production levels, more closely matching those expected longer term, and seeing their inventory recover. At this stage, we strongly urge CPGs to have a strategy for demand prediction, utilizing store inventory visibility to prepare for the “new normal.” As consumers venture back out in greater numbers, there will be a draw down on demand, and CPGs will need to predict how fast this demand will decrease.

The big question will be: How do you predict that demand? Through historical data, consumption, or shipments as in the past? These data points will only get you so far with high levels of inaccuracy. Predicting ongoing demand becomes similar to predicting the weather – very difficult, and nearly impossible to do with any level of confidence more than 10 days in the future.

Repair (measured in years)

This phase may feel like it’s in the distant future, but the timing for “Repair” may be less than two quarters away for the US and Europe. When the shelves are full, consumer demand has normalized, and the store looks perfect, don’t be fooled – there’s still plenty more work to be done to repair practices that drive our business in the long term.

Promo execution and new item launches will come back into focus. Right now, consumers aren’t responding to promotions as they would have in the past, and retailers and manufacturers aren’t managing those promotions like they would have in the past either – if they’re even running any at the moment. This means there’ll be plenty of work to be done to figure out how to get back to excellent promotional execution.

There will also be a push to tackle concerns that were set aside over the past several months. Store shelves may be full, but are the correct products on the shelf? Store compliance and On-Shelf Availability will be front and center. Current estimates for on-shelf availability rates for this time are at 85% to 90% but could very well be lower. We’ll need to repair computer assisted ordering issues and underlying spikes in phantom inventory and store ordering issues brought about by chronic D-Voids linked to necessary store compliance improvements. Solving these issues and repairing the damage that has been done is far from easy and will take a concerted effort over multiple years, but it is possible!

So, Where Are We Now?

China: Coming out of the recovery phase and moving into the repair phase. Shelves at retailers are full, but OOS rates at the average retailer for the average CPG is 18%. The right items are not getting on the shelf in the right place – Store Compliance and OSA are a top concern.

North America and Europe: Currently sitting in the middle of the Mitigate phase, still experiencing high sales rates and working on managing what stock they do have across retailers and regions, throttling production accordingly, and adjust SKU availability to meet consumer needs.

India, Mexico, and Latin America: These countries are early in the pandemic, just beginning to flex production and tackle allocation issues as they move into the Mitigate phase.

Key Takeaways:

CPGs and Retailers across the globe have a long road ahead to manage their business through the pandemic and into recovery in the years ahead, but there are numerous positives for those companies that handle the upcoming months well.

- The next 3 years looks excellent for CPGs, particularly big brands. The longer people are at home, the more they will consume at home; getting back to the simpler values that tend to resonate with many iconic brands.

- The next 12-18 months are going to be tricky. The supply chain and retail execution sides of the business will have their work cut out for them, but it will be worth it!

- The biggest winners will be the CPGs who execute flawlessly across all 4 phases.

Leave a Reply

You must be logged in to post a comment.